Your Average cost of wind and hail insurance images are available. Average cost of wind and hail insurance are a topic that is being searched for and liked by netizens today. You can Download the Average cost of wind and hail insurance files here. Find and Download all royalty-free photos and vectors.

If you’re searching for average cost of wind and hail insurance pictures information connected with to the average cost of wind and hail insurance interest, you have come to the right site. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

Average Cost Of Wind And Hail Insurance. Say your home is insured for $500,000 and your wind/hail deductible is 3%. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car. With reference to cars, the average payout is three times less.

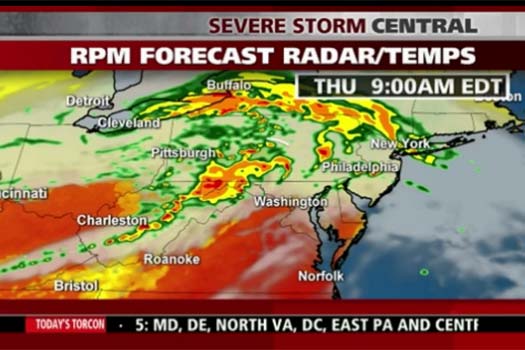

Wind Hail Storm Damage Total Pro Roofing From totalproroofing.com

Wind Hail Storm Damage Total Pro Roofing From totalproroofing.com

Of course, we mean the compensation for hail damage to a private house or apartment. Hail this size can damage your home and roof. Say your home is insured for $500,000 and your wind/hail deductible is 3%. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%.

Of course, we mean the compensation for hail damage to a private house or apartment.

Hail this size can damage your home and roof. The average cost of homeowners insurance in the u.s. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%. Say your home is insured for $500,000 and your wind/hail deductible is 3%.

Source: airsolutioncompany.com

Source: airsolutioncompany.com

According to the data of insurance companies for the last year, in 2020, the average insurance payout for hail damage was $12,000, taking into account the deductible taken away. The average cost of homeowners insurance in the u.s. While hail can be small, when a severe thunderstorm hits the damage can be extensive as the hail can range 1 to 1.75 inches in diameter. Of course, we mean the compensation for hail damage to a private house or apartment. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit.

Source: insureon.com

Source: insureon.com

Say your home is insured for $500,000 and your wind/hail deductible is 3%. The average cost of homeowners insurance in the u.s. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Say your home is insured for $500,000 and your wind/hail deductible is 3%. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car.

Source: nelsoncontractingllc.com

Source: nelsoncontractingllc.com

This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Of course, we mean the compensation for hail damage to a private house or apartment. According to the data of insurance companies for the last year, in 2020, the average insurance payout for hail damage was $12,000, taking into account the deductible taken away. Hail this size can damage your home and roof. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%.

Source: autotrends.org

Source: autotrends.org

According to the data of insurance companies for the last year, in 2020, the average insurance payout for hail damage was $12,000, taking into account the deductible taken away. Hail this size can damage your home and roof. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%. According to the data of insurance companies for the last year, in 2020, the average insurance payout for hail damage was $12,000, taking into account the deductible taken away. With reference to cars, the average payout is three times less.

Source: totalproroofing.com

Source: totalproroofing.com

While hail can be small, when a severe thunderstorm hits the damage can be extensive as the hail can range 1 to 1.75 inches in diameter. With reference to cars, the average payout is three times less. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car.

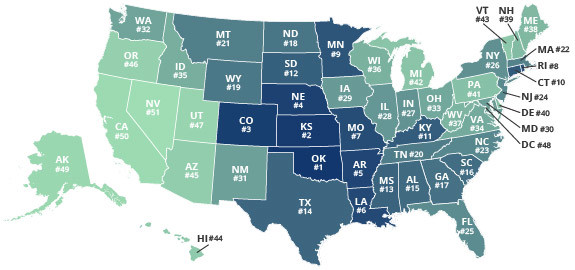

Source: youngalfred.com

Source: youngalfred.com

Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car. The average cost of homeowners insurance in the u.s. According to the data of insurance companies for the last year, in 2020, the average insurance payout for hail damage was $12,000, taking into account the deductible taken away. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%.

Source: cmcroofingservices.com

Source: cmcroofingservices.com

Of course, we mean the compensation for hail damage to a private house or apartment. Hail this size can damage your home and roof. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%. Of course, we mean the compensation for hail damage to a private house or apartment. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car.

Source: verisk.com

Source: verisk.com

Say your home is insured for $500,000 and your wind/hail deductible is 3%. Say your home is insured for $500,000 and your wind/hail deductible is 3%. While hail can be small, when a severe thunderstorm hits the damage can be extensive as the hail can range 1 to 1.75 inches in diameter. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. Of course, we mean the compensation for hail damage to a private house or apartment.

Source: totalproroofing.com

Source: totalproroofing.com

The average cost of homeowners insurance in the u.s. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car. Of course, we mean the compensation for hail damage to a private house or apartment. Say your home is insured for $500,000 and your wind/hail deductible is 3%. Hail this size can damage your home and roof.

Source: dentshop.com

Source: dentshop.com

With reference to cars, the average payout is three times less. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. According to the data of insurance companies for the last year, in 2020, the average insurance payout for hail damage was $12,000, taking into account the deductible taken away. Of course, we mean the compensation for hail damage to a private house or apartment.

Source: fudgeinsurance.com

Source: fudgeinsurance.com

This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Of course, we mean the compensation for hail damage to a private house or apartment. Hail this size can damage your home and roof. The average cost of homeowners insurance in the u.s. Say your home is insured for $500,000 and your wind/hail deductible is 3%.

Source: pinterest.com

Source: pinterest.com

The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. While hail can be small, when a severe thunderstorm hits the damage can be extensive as the hail can range 1 to 1.75 inches in diameter. With reference to cars, the average payout is three times less.

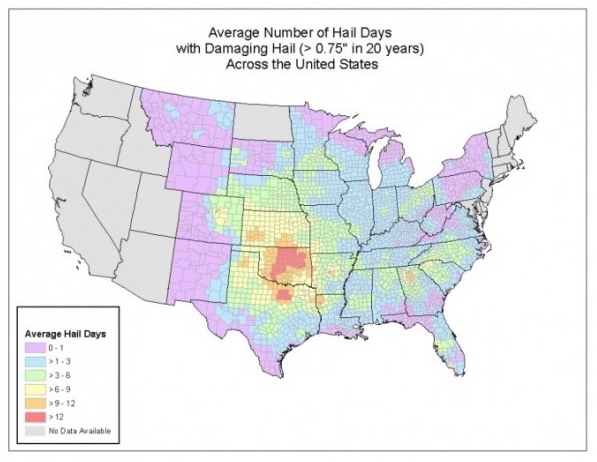

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

The average cost of homeowners insurance in the u.s. Say your home is insured for $500,000 and your wind/hail deductible is 3%. The average cost of homeowners insurance in the u.s. Of course, we mean the compensation for hail damage to a private house or apartment. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car.

This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Say your home is insured for $500,000 and your wind/hail deductible is 3%. Hail this size can damage your home and roof. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%. According to the data of insurance companies for the last year, in 2020, the average insurance payout for hail damage was $12,000, taking into account the deductible taken away.

Source: didyouknowcars.com

Source: didyouknowcars.com

With reference to cars, the average payout is three times less. The average cost of homeowners insurance in the u.s. With reference to cars, the average payout is three times less. While hail can be small, when a severe thunderstorm hits the damage can be extensive as the hail can range 1 to 1.75 inches in diameter. Hail this size can damage your home and roof.

Source: kapellaroofing.com

Source: kapellaroofing.com

This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. Much bigger hail is possible with major storms generating hail the size of a grapefruit (4.5 inches in diameter), which can do major damage to your home and car. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. Of course, we mean the compensation for hail damage to a private house or apartment. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim.

Source: canadianunderwriter.ca

Source: canadianunderwriter.ca

With reference to cars, the average payout is three times less. The average cost of homeowners insurance in the u.s. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. This is the amount you’re responsible for paying before your insurance will kick in on a wind or hail damage claim. While hail can be small, when a severe thunderstorm hits the damage can be extensive as the hail can range 1 to 1.75 inches in diameter.

Source: unitedhailpros.com

Source: unitedhailpros.com

Say your home is insured for $500,000 and your wind/hail deductible is 3%. Hail this size can damage your home and roof. The alabama insurance underwriting association offers wind/hail/hurricane deductible options of 1%, 2%, 5% and 10%. Of course, we mean the compensation for hail damage to a private house or apartment. While hail can be small, when a severe thunderstorm hits the damage can be extensive as the hail can range 1 to 1.75 inches in diameter.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title average cost of wind and hail insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.