Your Fire theft and windstorm damage are examples of images are available in this site. Fire theft and windstorm damage are examples of are a topic that is being searched for and liked by netizens today. You can Get the Fire theft and windstorm damage are examples of files here. Download all free images.

If you’re searching for fire theft and windstorm damage are examples of pictures information connected with to the fire theft and windstorm damage are examples of topic, you have pay a visit to the right site. Our site frequently gives you suggestions for downloading the highest quality video and picture content, please kindly hunt and find more informative video articles and images that match your interests.

Fire Theft And Windstorm Damage Are Examples Of. Therefore, if hail broke a window and damaged property inside, the loss would be covered. If you have sustained windstorm damage and losses,. If the window was left open, however, damage to property would not be covered. As well as specific exclusions.

Lightning Damage From olympicpa.com

Lightning Damage From olympicpa.com

If the window was left open, however, damage to property would not be covered. When big winds harm roofs and windows, rain and debris can cause additional damage. As well as specific exclusions. Windstorm insurance will typically cover physical damage to the property and personal belongings inside the home. Many policies also include coverage for detached structures such as garages and sheds. Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities).

Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities).

Windstorm insurance will typically cover physical damage to the property and personal belongings inside the home. Many policies also include coverage for detached structures such as garages and sheds. Below are just some of the examples of issues usually present that result in a storm damage claim: In such cases, most policies will cover repairs as long as. As well as specific exclusions. Therefore, if hail broke a window and damaged property inside, the loss would be covered.

Source: propertydamageinsuranceclaimsattorneys.com

Source: propertydamageinsuranceclaimsattorneys.com

In such cases, most policies will cover repairs as long as. When big winds harm roofs and windows, rain and debris can cause additional damage. Below are just some of the examples of issues usually present that result in a storm damage claim: Therefore, if hail broke a window and damaged property inside, the loss would be covered. As well as specific exclusions.

Source: keysclaims.com

Source: keysclaims.com

Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). Therefore, if hail broke a window and damaged property inside, the loss would be covered. Below are just some of the examples of issues usually present that result in a storm damage claim: Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). If you have sustained windstorm damage and losses,.

Source: bluegrassinsurance.com

Source: bluegrassinsurance.com

Windstorm insurance will typically cover physical damage to the property and personal belongings inside the home. For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. If the window was left open, however, damage to property would not be covered. As well as specific exclusions. In such cases, most policies will cover repairs as long as.

Source: tampabayclaim.com

Source: tampabayclaim.com

When big winds harm roofs and windows, rain and debris can cause additional damage. If you have sustained windstorm damage and losses,. When big winds harm roofs and windows, rain and debris can cause additional damage. For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. In such cases, most policies will cover repairs as long as.

Source: ipartnerext.icicilombard.com

Source: ipartnerext.icicilombard.com

Therefore, if hail broke a window and damaged property inside, the loss would be covered. Windstorm insurance will typically cover physical damage to the property and personal belongings inside the home. If you have sustained windstorm damage and losses,. For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. When big winds harm roofs and windows, rain and debris can cause additional damage.

Source: theadjustergroup.com

Source: theadjustergroup.com

When big winds harm roofs and windows, rain and debris can cause additional damage. Therefore, if hail broke a window and damaged property inside, the loss would be covered. Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). As well as specific exclusions. For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail.

Source: mmscontracting.co.uk

Source: mmscontracting.co.uk

Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). Below are just some of the examples of issues usually present that result in a storm damage claim: Many policies also include coverage for detached structures such as garages and sheds. If you have sustained windstorm damage and losses,.

Source: gedlawyers.com

Source: gedlawyers.com

For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. In such cases, most policies will cover repairs as long as. Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). If you have sustained windstorm damage and losses,. Below are just some of the examples of issues usually present that result in a storm damage claim:

Source: merkurypublicadjusters.com

Source: merkurypublicadjusters.com

Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). If the window was left open, however, damage to property would not be covered. When big winds harm roofs and windows, rain and debris can cause additional damage. For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. Many policies also include coverage for detached structures such as garages and sheds.

Source: harrisbalcombe.com

Source: harrisbalcombe.com

When big winds harm roofs and windows, rain and debris can cause additional damage. Many policies also include coverage for detached structures such as garages and sheds. When big winds harm roofs and windows, rain and debris can cause additional damage. As well as specific exclusions. In such cases, most policies will cover repairs as long as.

Source: louislawgroup.com

Source: louislawgroup.com

Many policies also include coverage for detached structures such as garages and sheds. For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). When big winds harm roofs and windows, rain and debris can cause additional damage. If you have sustained windstorm damage and losses,.

Source: keysclaims.com

Source: keysclaims.com

If the window was left open, however, damage to property would not be covered. If you have sustained windstorm damage and losses,. As well as specific exclusions. In such cases, most policies will cover repairs as long as. Windstorm insurance will typically cover physical damage to the property and personal belongings inside the home.

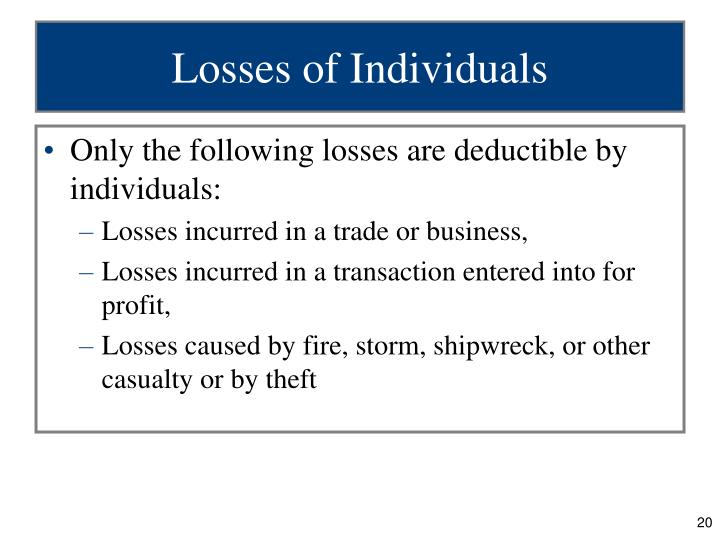

Source: slideserve.com

Source: slideserve.com

Windstorm insurance will typically cover physical damage to the property and personal belongings inside the home. If you have sustained windstorm damage and losses,. Below are just some of the examples of issues usually present that result in a storm damage claim: Therefore, if hail broke a window and damaged property inside, the loss would be covered. When big winds harm roofs and windows, rain and debris can cause additional damage.

Source: olympicpa.com

Source: olympicpa.com

For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. Windstorm insurance will typically cover physical damage to the property and personal belongings inside the home. As well as specific exclusions. In such cases, most policies will cover repairs as long as. Therefore, if hail broke a window and damaged property inside, the loss would be covered.

Source: publicadjustersassociates.com

Source: publicadjustersassociates.com

Below are just some of the examples of issues usually present that result in a storm damage claim: In such cases, most policies will cover repairs as long as. When big winds harm roofs and windows, rain and debris can cause additional damage. If you have sustained windstorm damage and losses,. Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities).

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Therefore, if hail broke a window and damaged property inside, the loss would be covered. If you have sustained windstorm damage and losses,. Many policies also include coverage for detached structures such as garages and sheds. For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. When big winds harm roofs and windows, rain and debris can cause additional damage.

Source: forthepublicadjusters.com

Source: forthepublicadjusters.com

Below are just some of the examples of issues usually present that result in a storm damage claim: If the window was left open, however, damage to property would not be covered. As well as specific exclusions. Many policies also include coverage for detached structures such as garages and sheds. Below are just some of the examples of issues usually present that result in a storm damage claim:

Source: empirepublicadjusters.com

Source: empirepublicadjusters.com

For example, damage by windstorm or hail topersonal property in a building is not covered unless the opening is caused by wind or hail. When big winds harm roofs and windows, rain and debris can cause additional damage. Types of losses include direct physical damage losses, theft losses, indirect or consequential losses (loss of use of property), and extra expenses (rent for temporary facilities). If the window was left open, however, damage to property would not be covered. Windstorm insurance will typically cover physical damage to the property and personal belongings inside the home.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fire theft and windstorm damage are examples of by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.