Your Is windstorm insurance required in texas images are available in this site. Is windstorm insurance required in texas are a topic that is being searched for and liked by netizens now. You can Find and Download the Is windstorm insurance required in texas files here. Get all free vectors.

If you’re searching for is windstorm insurance required in texas images information linked to the is windstorm insurance required in texas keyword, you have pay a visit to the right blog. Our site always gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

Is Windstorm Insurance Required In Texas. The homeowner can add optional coverages to the policy to increase their premium. Windstorm insurance policies are priced on the property itself. However, rates are determined by the location, condition, age, and coverage limits. Understanding your windstorm insurance in texas 09/16/2021 07/15/2020 by paula smith it’d be nice to think that getting a standard homeowners’ insurance would simply protect you from everything all in one policy, but the reality is very different.

Texas Windstorm Insurance Association Come On Over Today To The From eliseimageselise.blogspot.com

Texas Windstorm Insurance Association Come On Over Today To The From eliseimageselise.blogspot.com

However, rates are determined by the location, condition, age, and coverage limits. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. Texas has a variety of windstorm insurance rates. The average premium of a windstorm insurance policy from twia runs about $1,600 per year. The homeowner can add optional coverages to the policy to increase their premium. The age of your home, its value, and most importantly, the location of your home concerning the coast, will all play a role in how much your policy.

The homeowner can add optional coverages to the policy to increase their premium.

If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. The homeowner can add optional coverages to the policy to increase their premium. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. Understanding your windstorm insurance in texas 09/16/2021 07/15/2020 by paula smith it’d be nice to think that getting a standard homeowners’ insurance would simply protect you from everything all in one policy, but the reality is very different. Twia policies cost $1600 per year. However, rates are determined by the location, condition, age, and coverage limits.

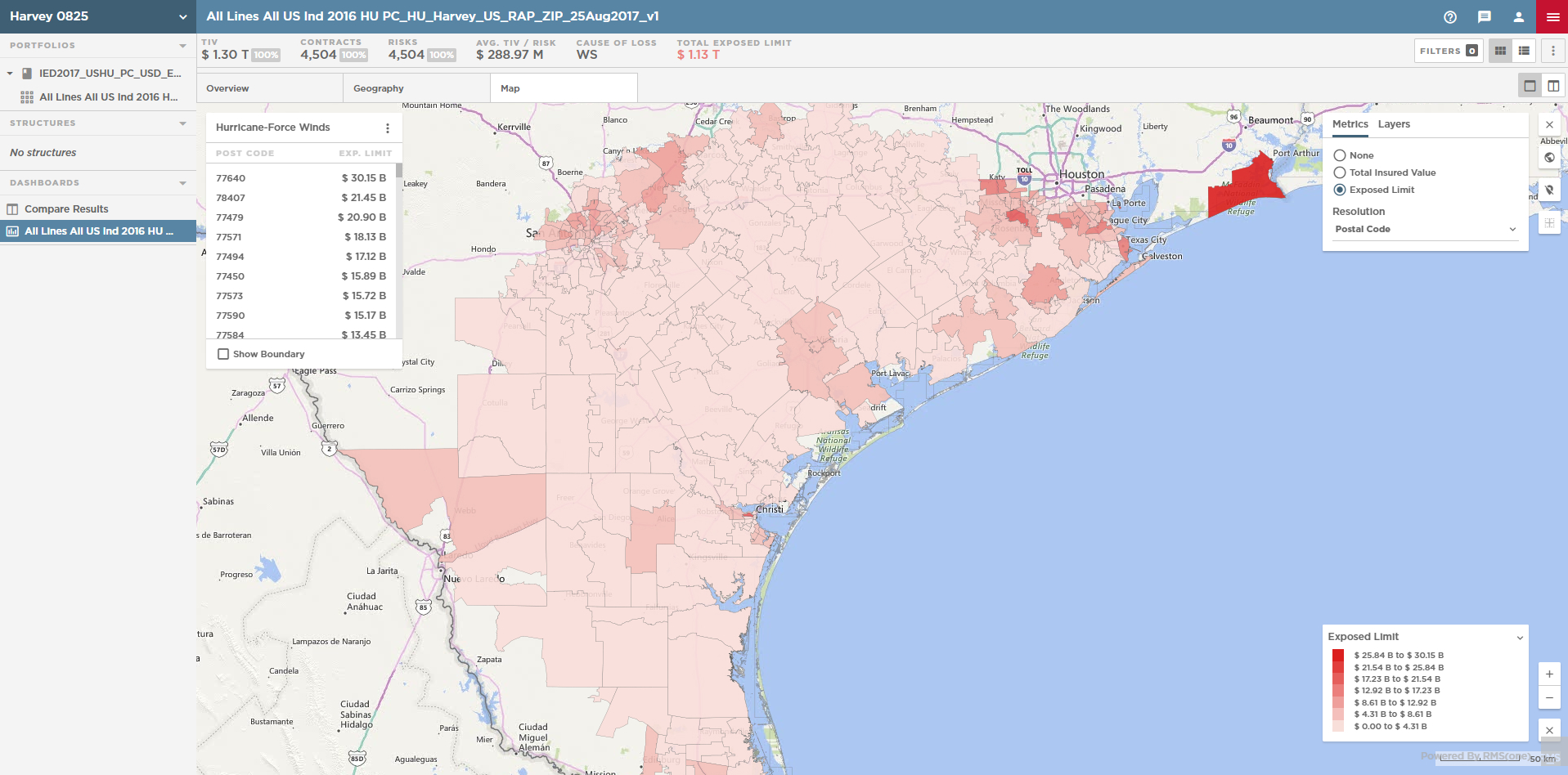

Source: texasengineer.com

Source: texasengineer.com

The age of your home, its value, and most importantly, the location of your home concerning the coast, will all play a role in how much your policy. However, rates are determined by the location, condition, age, and coverage limits. The average premium of a windstorm insurance policy from twia runs about $1,600 per year. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. Twia policies cost $1600 per year.

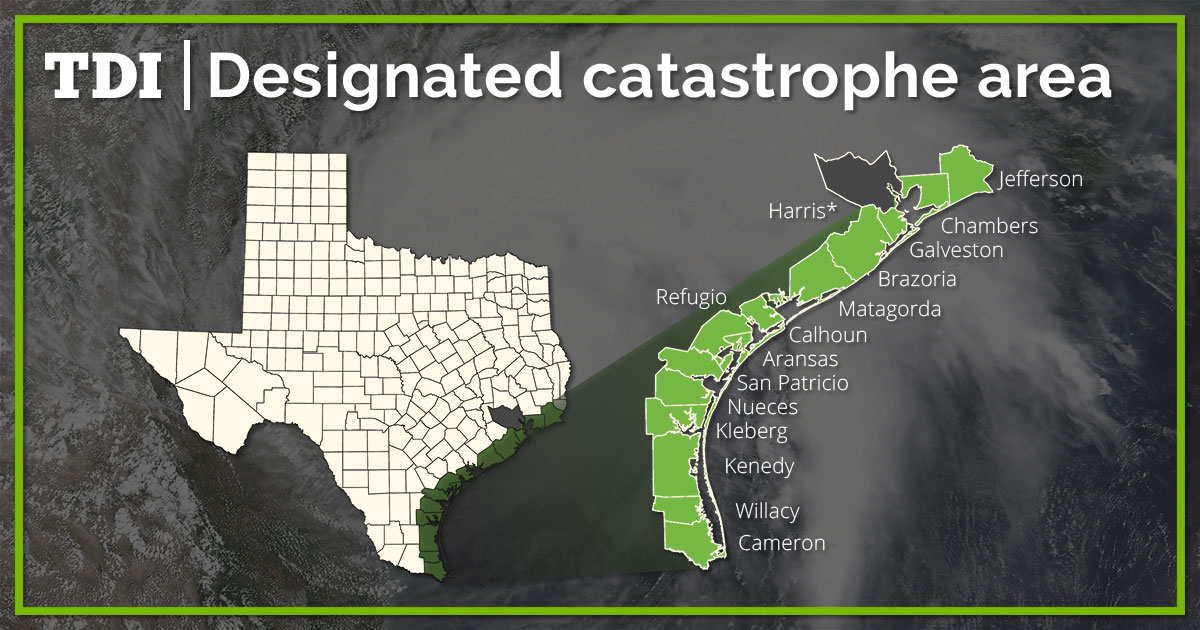

Source: opic.texas.gov

Source: opic.texas.gov

However, rates are determined by the location, condition, age, and coverage limits. Understanding your windstorm insurance in texas 09/16/2021 07/15/2020 by paula smith it’d be nice to think that getting a standard homeowners’ insurance would simply protect you from everything all in one policy, but the reality is very different. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. Twia policies cost $1600 per year. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors.

Source: appscenter.tdi.texas.gov

Source: appscenter.tdi.texas.gov

The homeowner can add optional coverages to the policy to increase their premium. Twia policies cost $1600 per year. However, rates are determined by the location, condition, age, and coverage limits. The age of your home, its value, and most importantly, the location of your home concerning the coast, will all play a role in how much your policy. Windstorm insurance policies are priced on the property itself.

Source: insurify.com

Source: insurify.com

Texas has a variety of windstorm insurance rates. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. Twia policies cost $1600 per year. The homeowner can add optional coverages to the policy to increase their premium.

Source: eliseimageselise.blogspot.com

Source: eliseimageselise.blogspot.com

Twia policies cost $1600 per year. Understanding your windstorm insurance in texas 09/16/2021 07/15/2020 by paula smith it’d be nice to think that getting a standard homeowners’ insurance would simply protect you from everything all in one policy, but the reality is very different. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. Twia policies cost $1600 per year. Windstorm insurance policies are priced on the property itself.

Source: valleycentral.com

Source: valleycentral.com

The age of your home, its value, and most importantly, the location of your home concerning the coast, will all play a role in how much your policy. Windstorm insurance policies are priced on the property itself. However, rates are determined by the location, condition, age, and coverage limits. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. Twia policies cost $1600 per year.

Source: pinterest.com

Source: pinterest.com

The average premium of a windstorm insurance policy from twia runs about $1,600 per year. The homeowner can add optional coverages to the policy to increase their premium. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. Windstorm insurance policies are priced on the property itself. The age of your home, its value, and most importantly, the location of your home concerning the coast, will all play a role in how much your policy.

Source: texastribune.org

Source: texastribune.org

Texas has a variety of windstorm insurance rates. Windstorm insurance policies are priced on the property itself. Understanding your windstorm insurance in texas 09/16/2021 07/15/2020 by paula smith it’d be nice to think that getting a standard homeowners’ insurance would simply protect you from everything all in one policy, but the reality is very different. However, rates are determined by the location, condition, age, and coverage limits. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors.

Source: appscenter.tdi.texas.gov

Source: appscenter.tdi.texas.gov

If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. However, rates are determined by the location, condition, age, and coverage limits. Texas has a variety of windstorm insurance rates. Windstorm insurance policies are priced on the property itself.

Source: reformaustin.org

Source: reformaustin.org

The average premium of a windstorm insurance policy from twia runs about $1,600 per year. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. Twia policies cost $1600 per year. The homeowner can add optional coverages to the policy to increase their premium.

Source: paulasmithinsurance.com

Source: paulasmithinsurance.com

Windstorm insurance policies are priced on the property itself. However, rates are determined by the location, condition, age, and coverage limits. Texas has a variety of windstorm insurance rates. The homeowner can add optional coverages to the policy to increase their premium. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors.

Source: tdi.texas.gov

Source: tdi.texas.gov

Texas has a variety of windstorm insurance rates. Twia policies cost $1600 per year. The average premium of a windstorm insurance policy from twia runs about $1,600 per year. The age of your home, its value, and most importantly, the location of your home concerning the coast, will all play a role in how much your policy. Texas has a variety of windstorm insurance rates.

Source: reformaustin.org

Source: reformaustin.org

Windstorm insurance policies are priced on the property itself. The homeowner can add optional coverages to the policy to increase their premium. The average premium of a windstorm insurance policy from twia runs about $1,600 per year. Windstorm insurance policies are priced on the property itself. Texas has a variety of windstorm insurance rates.

Source: twia.org

Source: twia.org

Texas has a variety of windstorm insurance rates. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. Twia policies cost $1600 per year. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. Texas has a variety of windstorm insurance rates.

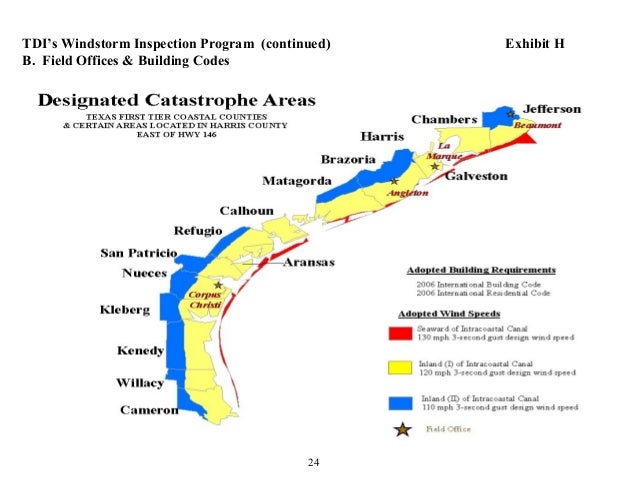

Source: es.slideshare.net

Source: es.slideshare.net

If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. Texas has a variety of windstorm insurance rates. Twia policies cost $1600 per year.

However, rates are determined by the location, condition, age, and coverage limits. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. Windstorm insurance policies are priced on the property itself. Twia policies cost $1600 per year. Understanding your windstorm insurance in texas 09/16/2021 07/15/2020 by paula smith it’d be nice to think that getting a standard homeowners’ insurance would simply protect you from everything all in one policy, but the reality is very different.

Source: slideshare.net

Source: slideshare.net

Windstorm insurance policies are priced on the property itself. However, rates are determined by the location, condition, age, and coverage limits. The age of your home, its value, and most importantly, the location of your home concerning the coast, will all play a role in how much your policy. If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors.

Source: slideshare.net

Source: slideshare.net

If your windstorm insurance deductible is 2% and you have $250,000 in dwelling coverage, you have to pay $5,000 (250,000 x 0.02) out of pocket before your insurer will pay. That being said, the cost of your individual windstorm insurance is going to depend on a variety of factors. The homeowner can add optional coverages to the policy to increase their premium. Understanding your windstorm insurance in texas 09/16/2021 07/15/2020 by paula smith it’d be nice to think that getting a standard homeowners’ insurance would simply protect you from everything all in one policy, but the reality is very different. Texas has a variety of windstorm insurance rates.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is windstorm insurance required in texas by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.