Your Named windstorm deductible images are ready. Named windstorm deductible are a topic that is being searched for and liked by netizens today. You can Get the Named windstorm deductible files here. Get all free vectors.

If you’re looking for named windstorm deductible images information connected with to the named windstorm deductible keyword, you have visit the right site. Our website frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

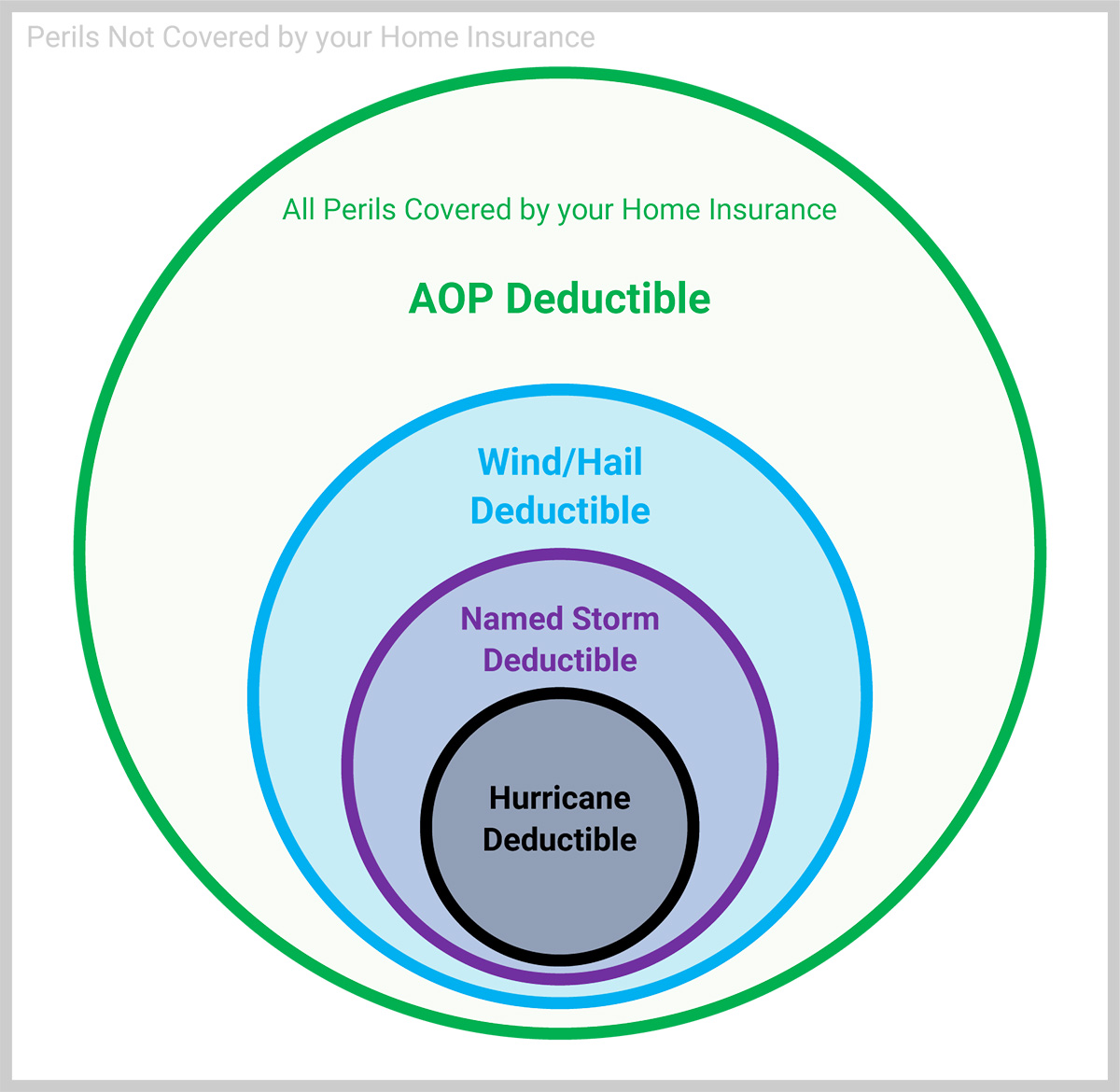

Named Windstorm Deductible. Percentages can range from 1% to 10% of the value of the insured home. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house.

Understanding and Applying the Louisiana Homeowners’ Hurricane, Named From propertyinsurancecoveragelaw.com

Understanding and Applying the Louisiana Homeowners’ Hurricane, Named From propertyinsurancecoveragelaw.com

Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses. If the clause applies a 10% deductible. Percentages can range from 1% to 10% of the value of the insured home. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock.

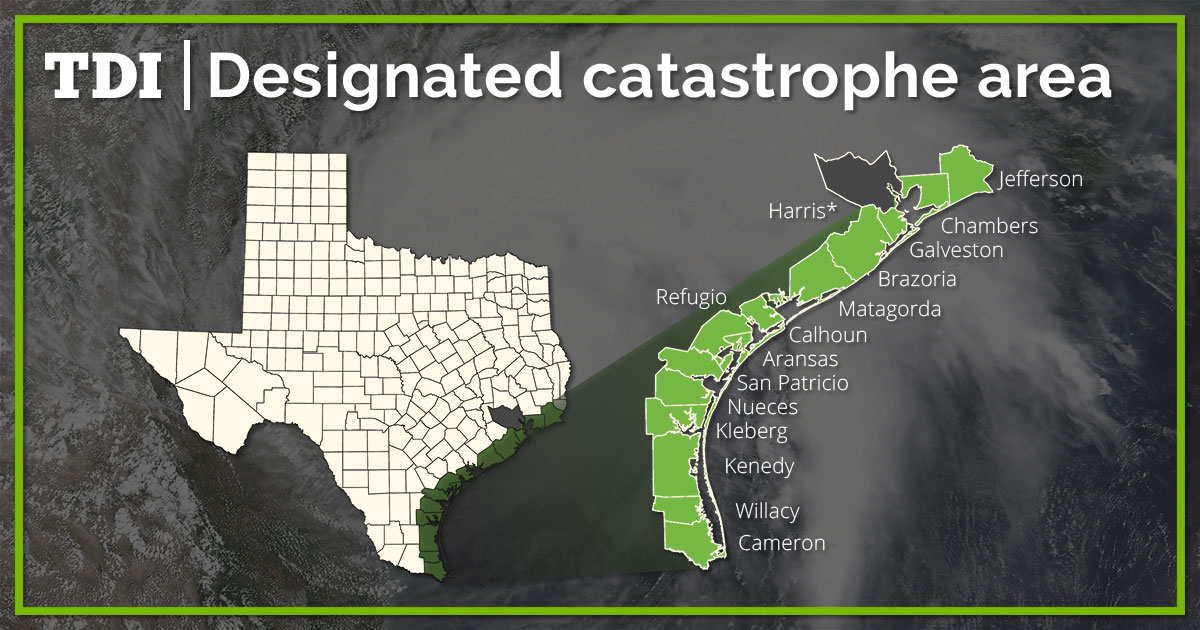

Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock.

A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible. Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. If the clause applies a 10% deductible. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. That seemingly modest figure, however, can take a big bite when 5 percent of an.

Source: calendarlocal.us

Source: calendarlocal.us

A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible. If the clause applies a 10% deductible. A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible. Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses. Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works.

Source: harrylevineinsurance.com

Source: harrylevineinsurance.com

Mississippi windstorm underwriting association (mwua, wind pool): That seemingly modest figure, however, can take a big bite when 5 percent of an. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible.

Source: glossariumdesign.blogspot.com

Source: glossariumdesign.blogspot.com

Percentages can range from 1% to 10% of the value of the insured home. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. If the clause applies a 10% deductible.

Source: insurancejournal.com

Source: insurancejournal.com

Mississippi windstorm underwriting association (mwua, wind pool): Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. Mississippi windstorm underwriting association (mwua, wind pool): Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses.

Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. That seemingly modest figure, however, can take a big bite when 5 percent of an. Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses.

Source: hiltonheadinsuranceandbrokerage.com

Source: hiltonheadinsuranceandbrokerage.com

Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses. If the clause applies a 10% deductible. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock.

Source: rmcgp.com

Source: rmcgp.com

For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. If the clause applies a 10% deductible.

Source: coverager.com

Source: coverager.com

Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. If the clause applies a 10% deductible.

Source: info.nnins.com

Source: info.nnins.com

Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. If the clause applies a 10% deductible. That seemingly modest figure, however, can take a big bite when 5 percent of an. Mississippi windstorm underwriting association (mwua, wind pool):

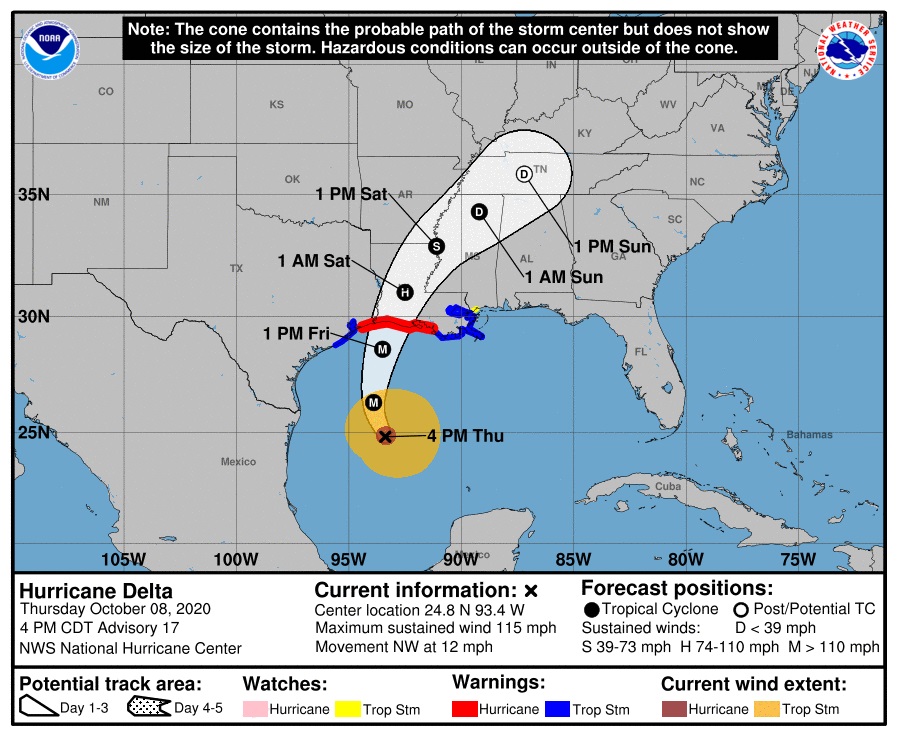

Source: cbs19.tv

Source: cbs19.tv

Mississippi windstorm underwriting association (mwua, wind pool): Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works. Percentages can range from 1% to 10% of the value of the insured home.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Mississippi windstorm underwriting association (mwua, wind pool): If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. That seemingly modest figure, however, can take a big bite when 5 percent of an. A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible.

Source: youngalfred.com

Source: youngalfred.com

Mississippi windstorm underwriting association (mwua, wind pool): Percentages can range from 1% to 10% of the value of the insured home. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock.

Source: hiltonheadinsuranceandbrokerage.com

Source: hiltonheadinsuranceandbrokerage.com

That seemingly modest figure, however, can take a big bite when 5 percent of an. A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses.

Source: blog.ecbm.com

Source: blog.ecbm.com

If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. If the clause applies a 10% deductible. Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works. If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock.

Source: barbeejackson.com

Source: barbeejackson.com

If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. That seemingly modest figure, however, can take a big bite when 5 percent of an. Mississippi windstorm underwriting association (mwua, wind pool): If your policy has this provision then a deductible of 5% or 10% (usually of the hull value insured) or whatever amount the underwriter has agreed to apply, would be deducted from your claim. Percentages can range from 1% to 10% of the value of the insured home.

Source: dcameragroup.com

Source: dcameragroup.com

Percentages can range from 1% to 10% of the value of the insured home. Insurers that use named storm or hurricane deductibles must clearly state on the homeowners policy the timing for the deductible and offer a practical example of how the deductible works. Mississippi windstorm underwriting association (mwua, wind pool): Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. Percentages can range from 1% to 10% of the value of the insured home.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. Some policies apply a minimum percentage to named storm, named windstorm and/or catastrophe losses. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. That seemingly modest figure, however, can take a big bite when 5 percent of an.

Source: calendarlocal.us

Source: calendarlocal.us

Percentages can range from 1% to 10% of the value of the insured home. For example, if a homeowners policy has a 5% named storm deductible on a $300,000 house. A named storm deductible is usually a percentage of the home’s value, making a policyholder responsible for a larger portion of a loss compared to their normal homeowners deductible. Mwua provides windstorm and hail coverage only in the coastal counties of george, hancock. That seemingly modest figure, however, can take a big bite when 5 percent of an.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title named windstorm deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.