Your Windstorm deductible buyback images are ready in this website. Windstorm deductible buyback are a topic that is being searched for and liked by netizens now. You can Download the Windstorm deductible buyback files here. Download all free photos.

If you’re searching for windstorm deductible buyback pictures information connected with to the windstorm deductible buyback keyword, you have visit the ideal site. Our site frequently gives you suggestions for seeking the highest quality video and image content, please kindly hunt and locate more informative video articles and images that match your interests.

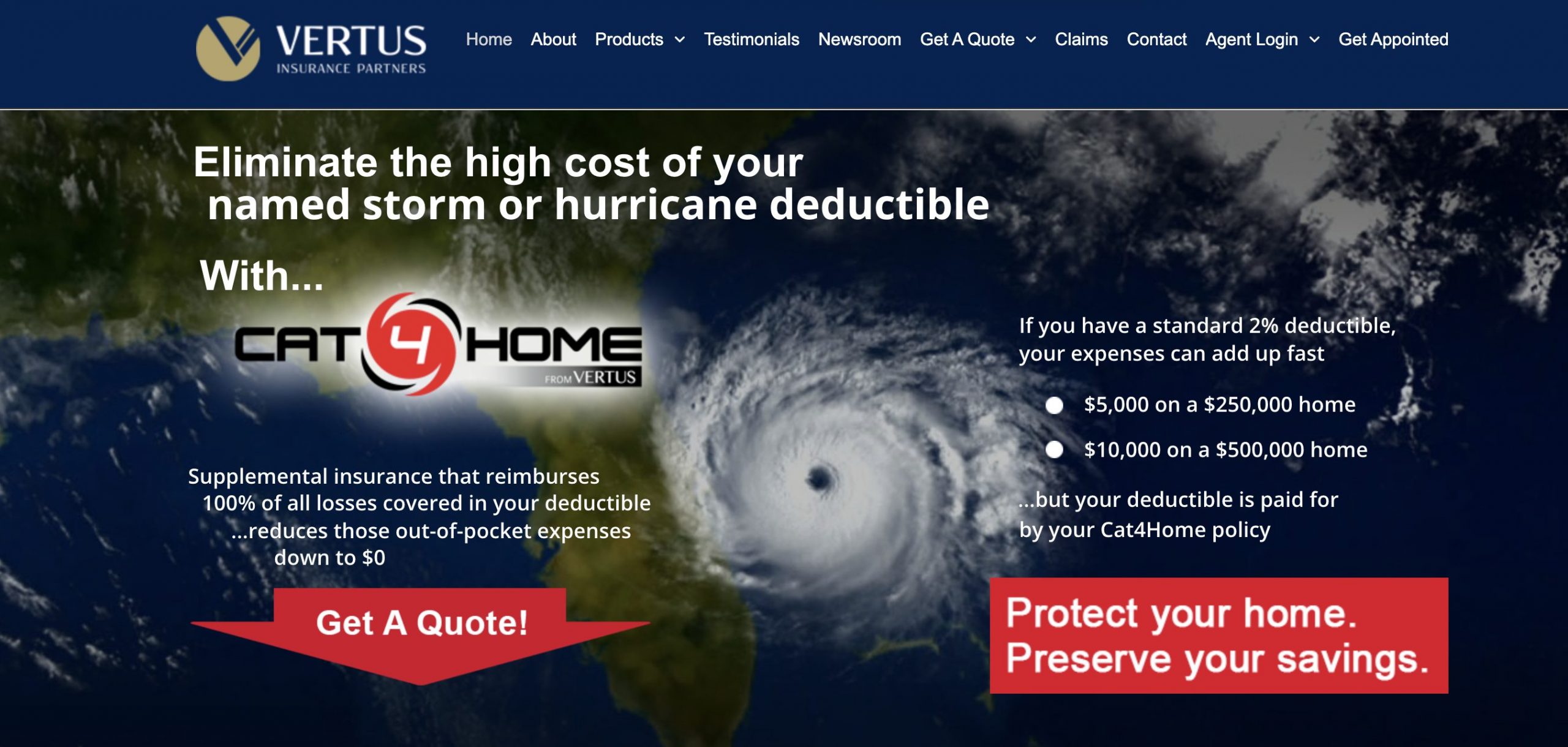

Windstorm Deductible Buyback. Safehold works directly with lloyd’s of london on these coverages. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million. By adding a standalone wind buyback policy, the business owner could lower the deductible from 5 percent to 1 percent or to $10,000 from $50,000. A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril.

Wind Deductible Buy Back Coverages Breckenridge Insurance From breckis.com

Wind Deductible Buy Back Coverages Breckenridge Insurance From breckis.com

If a policyholder has a $2 million property, with a 5% wind deductible of $100,000, they could purchase a separate wind buyback policy to. Safehold works directly with lloyd’s of london on these coverages. Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000. Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only. Consider the business owner who carries a 5 percent wind deductible which amounts to a $50,000 financial burden on a $1 million property.

Savings toward deductibles can be significant.

Without any buybacks in place, the homeowner would need to pay their full. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk. By adding a standalone wind buyback policy, the business owner could lower the deductible from 5 percent to 1 percent or to $10,000 from $50,000. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000. Without any buybacks in place, the homeowner would need to pay their full.

Source: insurancebusinessmag.com

Source: insurancebusinessmag.com

A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril. Without any buybacks in place, the homeowner would need to pay their full. Consider the business owner who carries a 5 percent wind deductible which amounts to a $50,000 financial burden on a $1 million property. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million.

Source: starkloss.com

Source: starkloss.com

Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only. Without any buybacks in place, the homeowner would need to pay their full. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million. Consider the business owner who carries a 5 percent wind deductible which amounts to a $50,000 financial burden on a $1 million property.

Source: mjkelly.com

Source: mjkelly.com

Safehold works directly with lloyd’s of london on these coverages. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000. Without any buybacks in place, the homeowner would need to pay their full. By adding a standalone wind buyback policy, the business owner could lower the deductible from 5 percent to 1 percent or to $10,000 from $50,000. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to.

Source: safehold.com

Source: safehold.com

Savings toward deductibles can be significant. A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril. Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000. By adding a standalone wind buyback policy, the business owner could lower the deductible from 5 percent to 1 percent or to $10,000 from $50,000.

Source: programbusiness.com

Source: programbusiness.com

Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. Without any buybacks in place, the homeowner would need to pay their full. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million. If a policyholder has a $2 million property, with a 5% wind deductible of $100,000, they could purchase a separate wind buyback policy to. Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk.

Source: mcgowanrisk.com

Source: mcgowanrisk.com

Savings toward deductibles can be significant. Consider the business owner who carries a 5 percent wind deductible which amounts to a $50,000 financial burden on a $1 million property. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million.

Source: prnewswire.com

Source: prnewswire.com

Savings toward deductibles can be significant. Without any buybacks in place, the homeowner would need to pay their full. By adding a standalone wind buyback policy, the business owner could lower the deductible from 5 percent to 1 percent or to $10,000 from $50,000. Safehold works directly with lloyd’s of london on these coverages. Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only.

Source: bsrinsurance.com

Source: bsrinsurance.com

Without any buybacks in place, the homeowner would need to pay their full. Safehold works directly with lloyd’s of london on these coverages. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million. A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril. Consider the business owner who carries a 5 percent wind deductible which amounts to a $50,000 financial burden on a $1 million property.

Source: wilmingtonmga.com

Source: wilmingtonmga.com

Without any buybacks in place, the homeowner would need to pay their full. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million. Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk. Savings toward deductibles can be significant. A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril.

Source: breckis.com

Source: breckis.com

Savings toward deductibles can be significant. Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million. Safehold works directly with lloyd’s of london on these coverages. If a policyholder has a $2 million property, with a 5% wind deductible of $100,000, they could purchase a separate wind buyback policy to.

Source: coverager.com

Source: coverager.com

Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000. Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk. Without any buybacks in place, the homeowner would need to pay their full. Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only.

Source: breckis.com

Source: breckis.com

Consider the business owner who carries a 5 percent wind deductible which amounts to a $50,000 financial burden on a $1 million property. Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only. Safehold works directly with lloyd’s of london on these coverages. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril.

Source: novusinsurancebrokers.com

Source: novusinsurancebrokers.com

Consider the business owner who carries a 5 percent wind deductible which amounts to a $50,000 financial burden on a $1 million property. Safehold works directly with lloyd’s of london on these coverages. Savings toward deductibles can be significant. A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril. Without any buybacks in place, the homeowner would need to pay their full.

Source: burnsandwilcox.com

Source: burnsandwilcox.com

Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. If a policyholder has a $2 million property, with a 5% wind deductible of $100,000, they could purchase a separate wind buyback policy to. Without any buybacks in place, the homeowner would need to pay their full. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril.

Source: uigusa.com

Source: uigusa.com

Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk. Without any buybacks in place, the homeowner would need to pay their full. Safehold works directly with lloyd’s of london on these coverages. Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to.

Source: empireunderwriters.com

Source: empireunderwriters.com

Safehold works directly with lloyd’s of london on these coverages. Savings toward deductibles can be significant. Without any buybacks in place, the homeowner would need to pay their full. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000.

Source: wilmingtonmga.com

Source: wilmingtonmga.com

Safehold works directly with lloyd’s of london on these coverages. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. Consider the business owner who carries a 5 percent wind deductible which amounts to a $50,000 financial burden on a $1 million property. As an example, on a home with an insured valued of $1,000,000, the standard five percent wind deductible would be $50,000. Typical policy terms are 12 months for commercial property and up to 36 months for builders’ risk.

Source: wilmingtonmga.com

Source: wilmingtonmga.com

A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril. Spreading the cost of wind disasters among property owners and additional insurers is a certainly good thing—except, perhaps, if you’re trying to get people to. A wind deductible buyback can essentially “lessen the blow” of the homeowners’ wind deductible following the triggering of a wind peril. Wind deductible buy back coverage can be written with or without an annual aggregate limit and can be written for wind in general or named windstorms only. Launched in florida in 2019 and expanded to three more coastal states in 2020, cat4home pays 100% of a separate wind deductible up to $100,000 on homes valued up to $5 million.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title windstorm deductible buyback by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.