Your Windstorm hurricane and hail exclusion images are available. Windstorm hurricane and hail exclusion are a topic that is being searched for and liked by netizens today. You can Find and Download the Windstorm hurricane and hail exclusion files here. Find and Download all free vectors.

If you’re searching for windstorm hurricane and hail exclusion images information linked to the windstorm hurricane and hail exclusion topic, you have visit the right blog. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

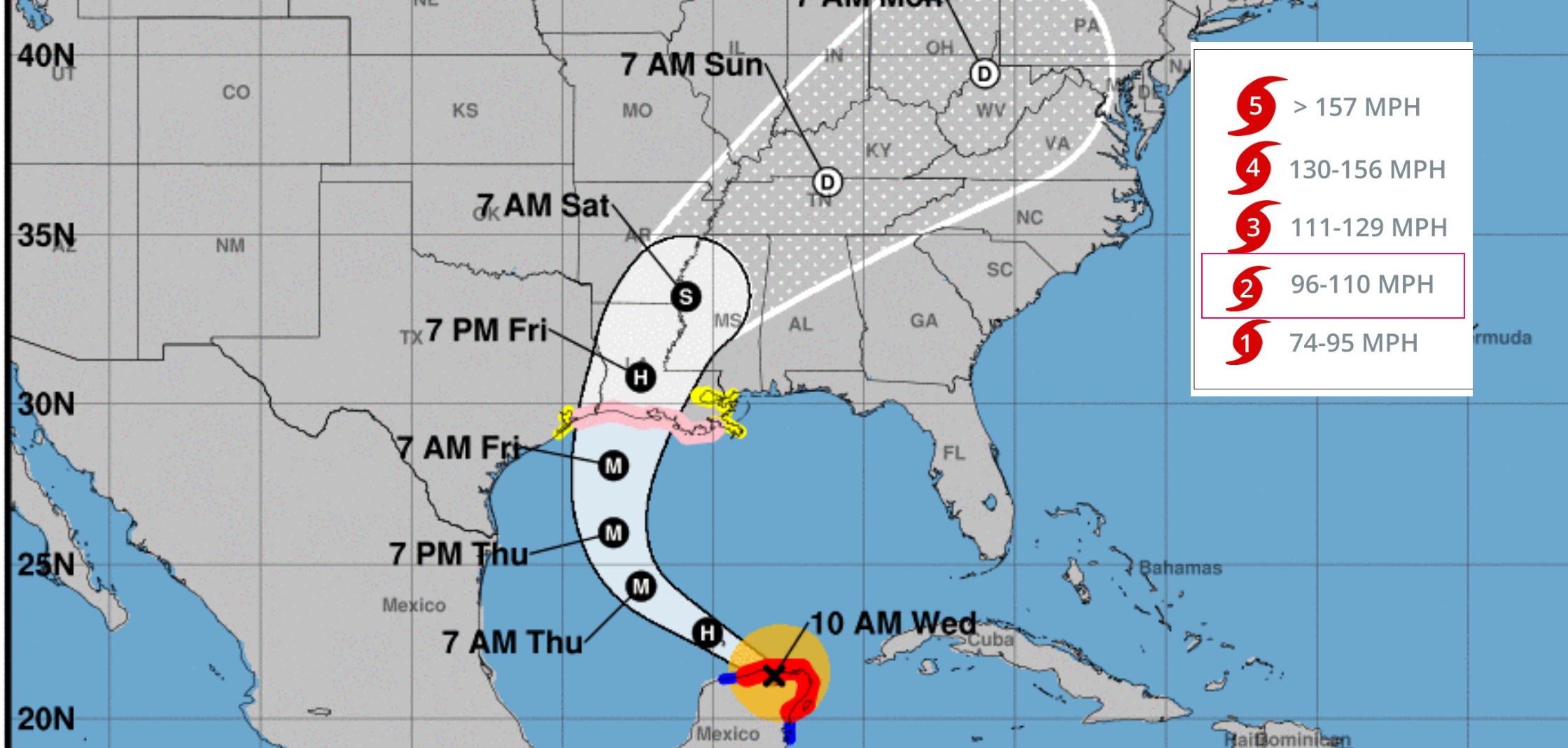

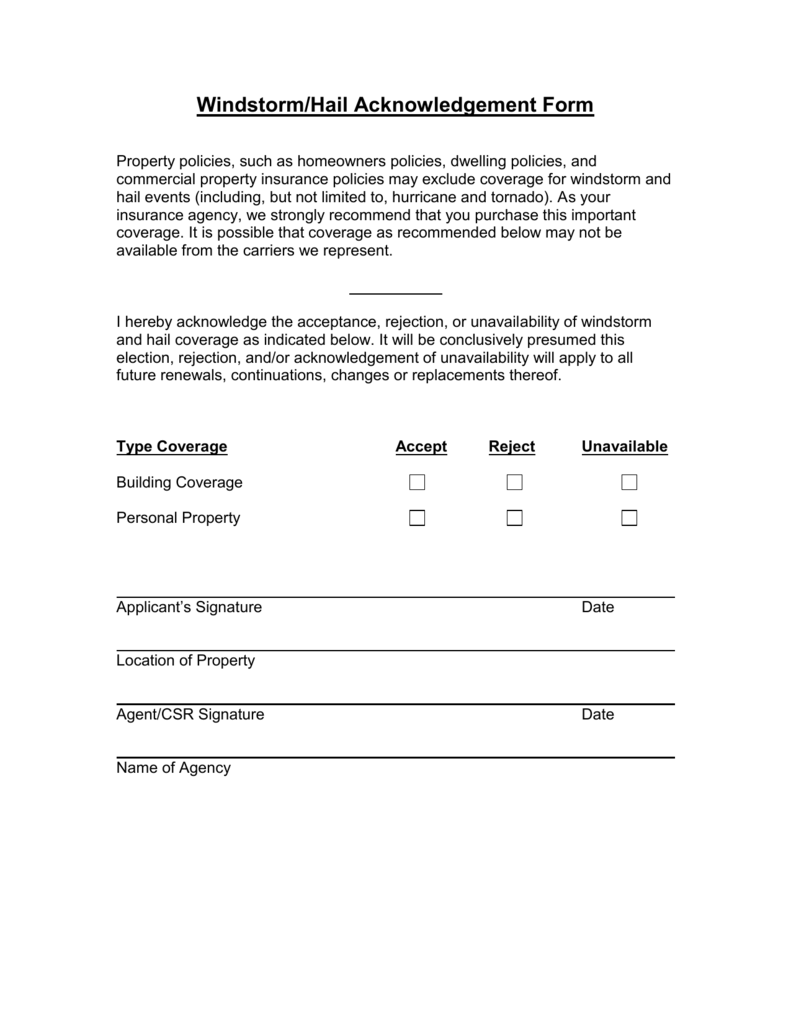

Windstorm Hurricane And Hail Exclusion. Windstorm hurricane and hail exclusion agreement. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. If included, the insurer must provide an example to show how the deductible works for a policy worth $100,000. Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage.

StormResistant Construction Protecting Property Value From hwconstruction.com

StormResistant Construction Protecting Property Value From hwconstruction.com

Storm insurance usually covers physical damage to. This endorsement does not exclude coverage for: A subset of storm insurance, storm insurance, is usually offered in the form of a driver with a standard accident insurance policy via extended coverage confirmation. The insurer must also include a clear explanation of the event […] Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. There are two kinds of wind damage deductibles:

Because roofs are often the target of this.

This endorsement does not exclude coverage for: A subset of storm insurance, storm insurance, is usually offered in the form of a driver with a standard accident insurance policy via extended coverage confirmation. A cosmetic damage exclusion means damage to exterior surfaces, including walls, roofs, doors, and windows that impact the appearance but not the function of these elements, may not be covered. These are things insurers consider superficial or cosmetic and are usually caused by perils like wind or hail. 20 kwietnia 2022 majer bez kategorii skomentuj. Windstorm hurricane and hail exclusion agreement.

Source: roperroofingandsolar.com

Source: roperroofingandsolar.com

Storm insurance usually covers physical damage to. A cosmetic damage exclusion means damage to exterior surfaces, including walls, roofs, doors, and windows that impact the appearance but not the function of these elements, may not be covered. Storm insurance usually covers physical damage to. 20 kwietnia 2022 majer bez kategorii skomentuj. This endorsement does not exclude coverage for:

Source: businessinsurance.co.za

Source: businessinsurance.co.za

A cosmetic damage exclusion means damage to exterior surfaces, including walls, roofs, doors, and windows that impact the appearance but not the function of these elements, may not be covered. 20 kwietnia 2022 majer bez kategorii skomentuj. Because roofs are often the target of this. Windstorm hurricane and hail exclusion agreement. Storm insurance usually covers physical damage to.

Source: insurancefortexans.com

Because roofs are often the target of this. Because roofs are often the target of this. There are two kinds of wind damage deductibles: Storm insurance usually covers physical damage to. These are things insurers consider superficial or cosmetic and are usually caused by perils like wind or hail.

Source: blog.homesteadroofingcolorado.com

Source: blog.homesteadroofingcolorado.com

There are two kinds of wind damage deductibles: There are two kinds of wind damage deductibles: These are things insurers consider superficial or cosmetic and are usually caused by perils like wind or hail. Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. If included, the insurer must provide an example to show how the deductible works for a policy worth $100,000.

Source: omaha.com

Source: omaha.com

Storm insurance usually covers physical damage to. There are two kinds of wind damage deductibles: If included, the insurer must provide an example to show how the deductible works for a policy worth $100,000. This endorsement does not exclude coverage for: Because roofs are often the target of this.

Source: msb.law

Source: msb.law

The insurer must also include a clear explanation of the event […] Insurers in south carolina are required to notify residential real estate policyholders if the policy contains a separate deductible for hurricane, hurricane or wind/hail damage. If included, the insurer must provide an example to show how the deductible works for a policy worth $100,000. Because roofs are often the target of this. Hail and other gust risks.

Source: twfg.xenithx.com

Source: twfg.xenithx.com

There are two kinds of wind damage deductibles: Storm insurance usually covers physical damage to. Insurers in south carolina are required to notify residential real estate policyholders if the policy contains a separate deductible for hurricane, hurricane or wind/hail damage. The insurer must also include a clear explanation of the event […] Because roofs are often the target of this.

Source: hwconstruction.com

Source: hwconstruction.com

Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. A subset of storm insurance, storm insurance, is usually offered in the form of a driver with a standard accident insurance policy via extended coverage confirmation. Storm insurance usually covers physical damage to. There are two kinds of wind damage deductibles:

Source: okinsurancelawblog.com

Source: okinsurancelawblog.com

Hail and other gust risks. A cosmetic damage exclusion means damage to exterior surfaces, including walls, roofs, doors, and windows that impact the appearance but not the function of these elements, may not be covered. Storm insurance usually covers physical damage to. The insurer must also include a clear explanation of the event […] Insurers in south carolina are required to notify residential real estate policyholders if the policy contains a separate deductible for hurricane, hurricane or wind/hail damage.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. This endorsement does not exclude coverage for: These are things insurers consider superficial or cosmetic and are usually caused by perils like wind or hail. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. Because roofs are often the target of this.

Source: dynamicroofingconcepts.com

Source: dynamicroofingconcepts.com

The insurer must also include a clear explanation of the event […] This endorsement does not exclude coverage for: 20 kwietnia 2022 majer bez kategorii skomentuj. Because roofs are often the target of this. There are two kinds of wind damage deductibles:

Source: blog.oneclickcontractor.com

Source: blog.oneclickcontractor.com

Storm insurance usually covers physical damage to. If included, the insurer must provide an example to show how the deductible works for a policy worth $100,000. The insurer must also include a clear explanation of the event […] These are things insurers consider superficial or cosmetic and are usually caused by perils like wind or hail. 20 kwietnia 2022 majer bez kategorii skomentuj.

Source: sunfloroofing.com

Source: sunfloroofing.com

If included, the insurer must provide an example to show how the deductible works for a policy worth $100,000. If included, the insurer must provide an example to show how the deductible works for a policy worth $100,000. Because roofs are often the target of this. Insurers in south carolina are required to notify residential real estate policyholders if the policy contains a separate deductible for hurricane, hurricane or wind/hail damage. The insurer must also include a clear explanation of the event […]

![]() Source: over50insurance.com.au

Source: over50insurance.com.au

Hail and other gust risks. Storm insurance usually covers physical damage to. Hail and other gust risks. The insurer must also include a clear explanation of the event […] Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage.

Source: studylib.net

Source: studylib.net

There are two kinds of wind damage deductibles: Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. Because roofs are often the target of this. If included, the insurer must provide an example to show how the deductible works for a policy worth $100,000.

Source: shingle.com.au

Source: shingle.com.au

Because roofs are often the target of this. This endorsement does not exclude coverage for: 20 kwietnia 2022 majer bez kategorii skomentuj. Insurers in south carolina are required to notify residential real estate policyholders if the policy contains a separate deductible for hurricane, hurricane or wind/hail damage. Because roofs are often the target of this.

Source: mountain-forecast.com

Source: mountain-forecast.com

A cosmetic damage exclusion means damage to exterior surfaces, including walls, roofs, doors, and windows that impact the appearance but not the function of these elements, may not be covered. There are two kinds of wind damage deductibles: This endorsement does not exclude coverage for: Insurers in south carolina are required to notify residential real estate policyholders if the policy contains a separate deductible for hurricane, hurricane or wind/hail damage. A subset of storm insurance, storm insurance, is usually offered in the form of a driver with a standard accident insurance policy via extended coverage confirmation.

Source: berryinsurance.com

Source: berryinsurance.com

Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. 20 kwietnia 2022 majer bez kategorii skomentuj. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. Storm insurance usually covers physical damage to. There are two kinds of wind damage deductibles:

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title windstorm hurricane and hail exclusion by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.