Your Windstorm or hail deductible images are available. Windstorm or hail deductible are a topic that is being searched for and liked by netizens now. You can Get the Windstorm or hail deductible files here. Find and Download all royalty-free vectors.

If you’re looking for windstorm or hail deductible images information linked to the windstorm or hail deductible keyword, you have come to the ideal site. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

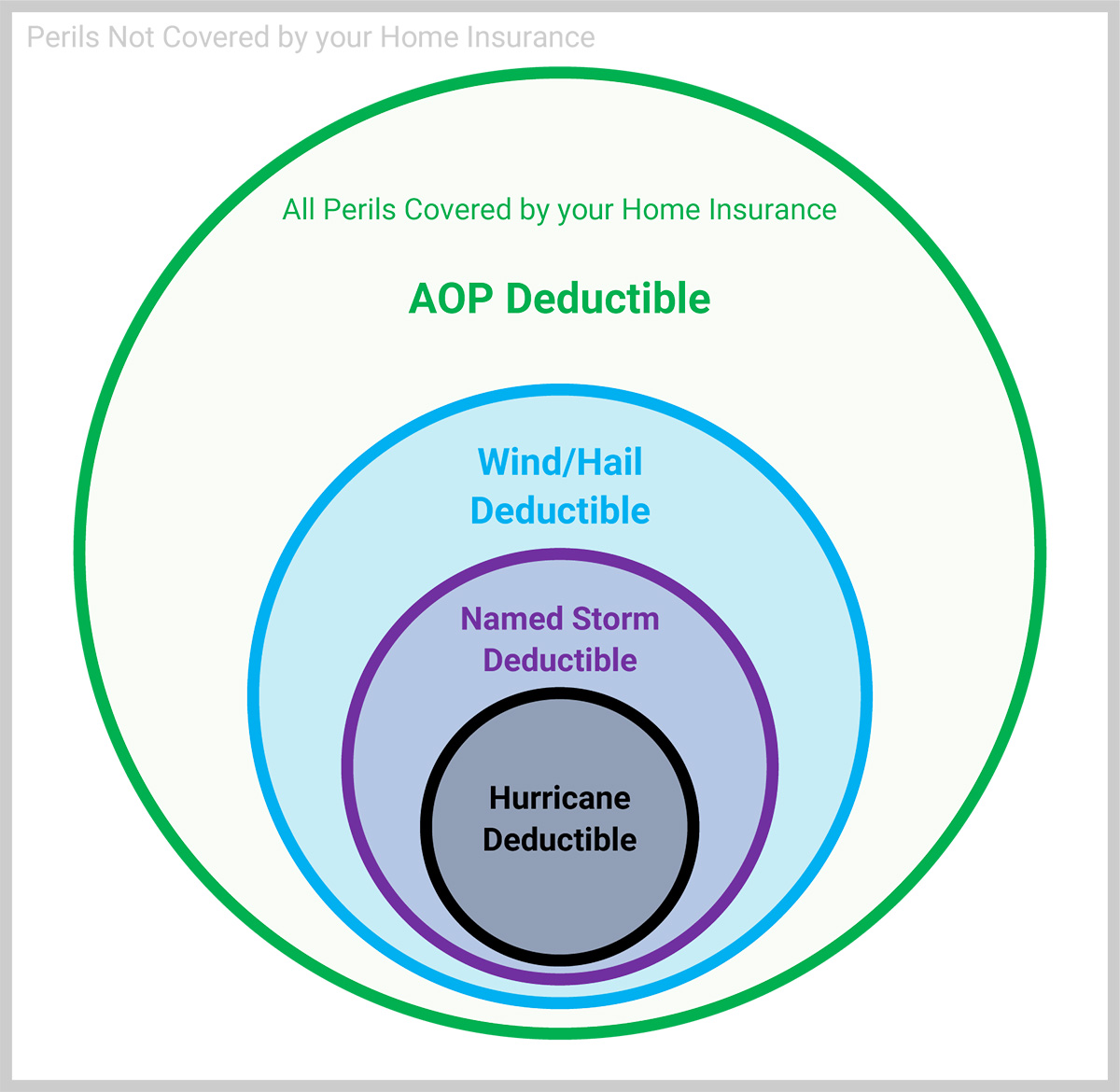

Windstorm Or Hail Deductible. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. There are two kinds of wind damage deductibles: Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage.

Does your policy include a separate “Wind or Hail Deductible”? From ahernagency.com

Does your policy include a separate “Wind or Hail Deductible”? From ahernagency.com

Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. Homeowners may pay a flat amount such as $1,000 or $2,000 per claim. Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage. This could be a summer thunderstorm, a winter nor’easter, or any hailstorm. There are two kinds of wind damage deductibles: Wind/hail deductibles are based on that concept.

Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit.

Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. Say your home is insured for $500,000 and your wind/hail deductible is 3%. Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage. There are two kinds of wind damage deductibles: Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. If wind is the cause of the dame, including if wind caused a tree fall into your house, then the wind & hail deductible is enforced.

Source: ahernagency.com

Source: ahernagency.com

Or, more commonly, homeowners may pay a percentage of their home insurance coverage, typically between 1 and 5 percent, according to the iii. Costs of wind/hail deductibles are usually calculated in one of two ways, bonelli says. Say your home is insured for $500,000 and your wind/hail deductible is 3%. Or, more commonly, homeowners may pay a percentage of their home insurance coverage, typically between 1 and 5 percent, according to the iii. Homeowners may pay a flat amount such as $1,000 or $2,000 per claim.

Source: hiltonheadinsuranceandbrokerage.com

Source: hiltonheadinsuranceandbrokerage.com

Or, more commonly, homeowners may pay a percentage of their home insurance coverage, typically between 1 and 5 percent, according to the iii. If wind is the cause of the dame, including if wind caused a tree fall into your house, then the wind & hail deductible is enforced. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. Or, more commonly, homeowners may pay a percentage of their home insurance coverage, typically between 1 and 5 percent, according to the iii. Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage.

Source: insurancefortexans.com

This could be a summer thunderstorm, a winter nor’easter, or any hailstorm. That means you’re responsible for paying $15,000 before insurance will kick in for a wind damage claim. Most insurance deductibles are set at a flat dollar amount. There are two kinds of wind damage deductibles: Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage.

Source: mulleninsurance.com

Source: mulleninsurance.com

Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. Or, more commonly, homeowners may pay a percentage of their home insurance coverage, typically between 1 and 5 percent, according to the iii. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. If you have a $1,000 deductible on a particular line of insurance, then you would pay the deductible amount of $1,000 on a claim before your insurance covers the cost of the rest of your claim.

Source: youngalfred.com

Source: youngalfred.com

Say your home is insured for $500,000 and your wind/hail deductible is 3%. Most insurance deductibles are set at a flat dollar amount. If wind is the cause of the dame, including if wind caused a tree fall into your house, then the wind & hail deductible is enforced. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. There are two kinds of wind damage deductibles:

Source: cmcroofingservices.com

Source: cmcroofingservices.com

Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. Most insurance deductibles are set at a flat dollar amount. Wind/hail deductibles are based on that concept. There are two kinds of wind damage deductibles:

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Costs of wind/hail deductibles are usually calculated in one of two ways, bonelli says. Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. Most insurance deductibles are set at a flat dollar amount. Costs of wind/hail deductibles are usually calculated in one of two ways, bonelli says. If you have a $1,000 deductible on a particular line of insurance, then you would pay the deductible amount of $1,000 on a claim before your insurance covers the cost of the rest of your claim.

Source: eckburg.com

Source: eckburg.com

Most insurance deductibles are set at a flat dollar amount. This could be a summer thunderstorm, a winter nor’easter, or any hailstorm. Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit. Wind/hail deductibles are based on that concept.

Source: hiltonheadinsuranceandbrokerage.com

Source: hiltonheadinsuranceandbrokerage.com

Or, more commonly, homeowners may pay a percentage of their home insurance coverage, typically between 1 and 5 percent, according to the iii. If wind is the cause of the dame, including if wind caused a tree fall into your house, then the wind & hail deductible is enforced. Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. There are two kinds of wind damage deductibles: Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit.

Source: chooseallstar.com

Source: chooseallstar.com

Costs of wind/hail deductibles are usually calculated in one of two ways, bonelli says. Wind/hail deductibles are based on that concept. That means you’re responsible for paying $15,000 before insurance will kick in for a wind damage claim. Most insurance deductibles are set at a flat dollar amount. Homeowners may pay a flat amount such as $1,000 or $2,000 per claim.

Source: insurancefortexans.com

Most insurance deductibles are set at a flat dollar amount. Say your home is insured for $500,000 and your wind/hail deductible is 3%. If wind is the cause of the dame, including if wind caused a tree fall into your house, then the wind & hail deductible is enforced. There are two kinds of wind damage deductibles: If you have a $1,000 deductible on a particular line of insurance, then you would pay the deductible amount of $1,000 on a claim before your insurance covers the cost of the rest of your claim.

Source: youtube.com

Source: youtube.com

Homeowners may pay a flat amount such as $1,000 or $2,000 per claim. That means you’re responsible for paying $15,000 before insurance will kick in for a wind damage claim. Wind/hail deductibles are based on that concept. Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage. There are two kinds of wind damage deductibles:

Source: lit438dld.blogspot.com

Source: lit438dld.blogspot.com

Or, more commonly, homeowners may pay a percentage of their home insurance coverage, typically between 1 and 5 percent, according to the iii. Homeowners may pay a flat amount such as $1,000 or $2,000 per claim. Costs of wind/hail deductibles are usually calculated in one of two ways, bonelli says. If you have a $1,000 deductible on a particular line of insurance, then you would pay the deductible amount of $1,000 on a claim before your insurance covers the cost of the rest of your claim. Wind/hail deductibles are typically percentage deductibles between 1% and 5% of your home’s dwelling coverage limit.

Source: sentarmeenunanube.blogspot.com

Source: sentarmeenunanube.blogspot.com

There are two kinds of wind damage deductibles: Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage. Percentage deductibles typically vary from 1 percent of a home�s insured value to 5 percent. That means you’re responsible for paying $15,000 before insurance will kick in for a wind damage claim. If wind is the cause of the dame, including if wind caused a tree fall into your house, then the wind & hail deductible is enforced.

Source: khwindows.com

Source: khwindows.com

Homeowners may pay a flat amount such as $1,000 or $2,000 per claim. If you have a $1,000 deductible on a particular line of insurance, then you would pay the deductible amount of $1,000 on a claim before your insurance covers the cost of the rest of your claim. Most insurance deductibles are set at a flat dollar amount. There are two kinds of wind damage deductibles: Say your home is insured for $500,000 and your wind/hail deductible is 3%.

Source: baker-roofing.com

Source: baker-roofing.com

If you have a $1,000 deductible on a particular line of insurance, then you would pay the deductible amount of $1,000 on a claim before your insurance covers the cost of the rest of your claim. That means you’re responsible for paying $15,000 before insurance will kick in for a wind damage claim. Most insurance deductibles are set at a flat dollar amount. Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage. This could be a summer thunderstorm, a winter nor’easter, or any hailstorm.

Source: programbusiness.com

Source: programbusiness.com

There are two kinds of wind damage deductibles: There are two kinds of wind damage deductibles: Wind/hail deductibles are based on that concept. Hurricane deductibles, which apply to damage solely from hurricanes, and windstorm or wind/hail deductibles, which apply to any kind of wind damage. Homeowners may pay a flat amount such as $1,000 or $2,000 per claim.

Source: propertyinsurancecoveragelaw.com

Source: propertyinsurancecoveragelaw.com

Wind/hail deductibles are based on that concept. That means you’re responsible for paying $15,000 before insurance will kick in for a wind damage claim. Wind and hail coverage uses a percentage deductible, usually between 1% and 5% of the damage. If you have a $1,000 deductible on a particular line of insurance, then you would pay the deductible amount of $1,000 on a claim before your insurance covers the cost of the rest of your claim. If wind is the cause of the dame, including if wind caused a tree fall into your house, then the wind & hail deductible is enforced.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title windstorm or hail deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.